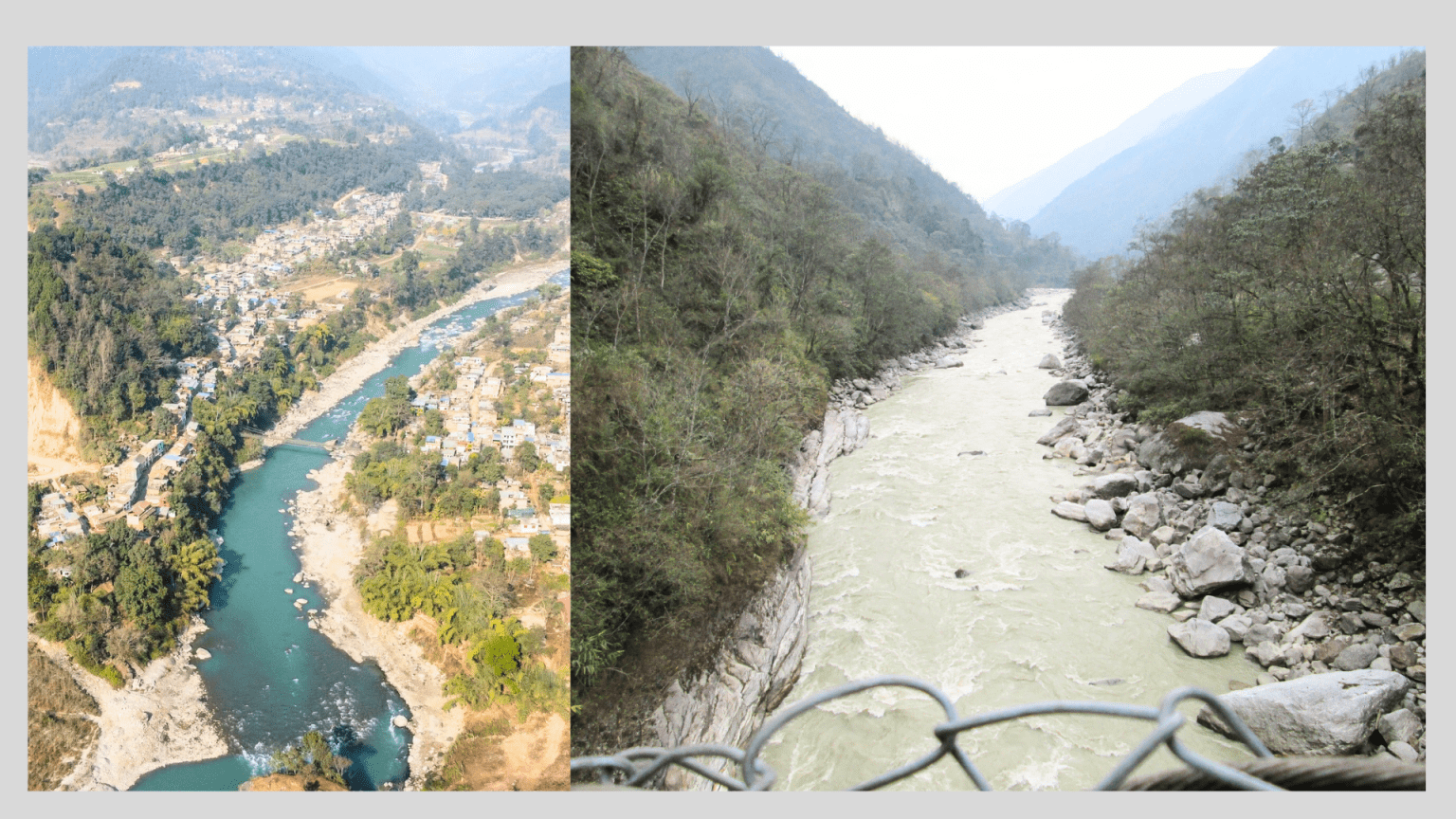

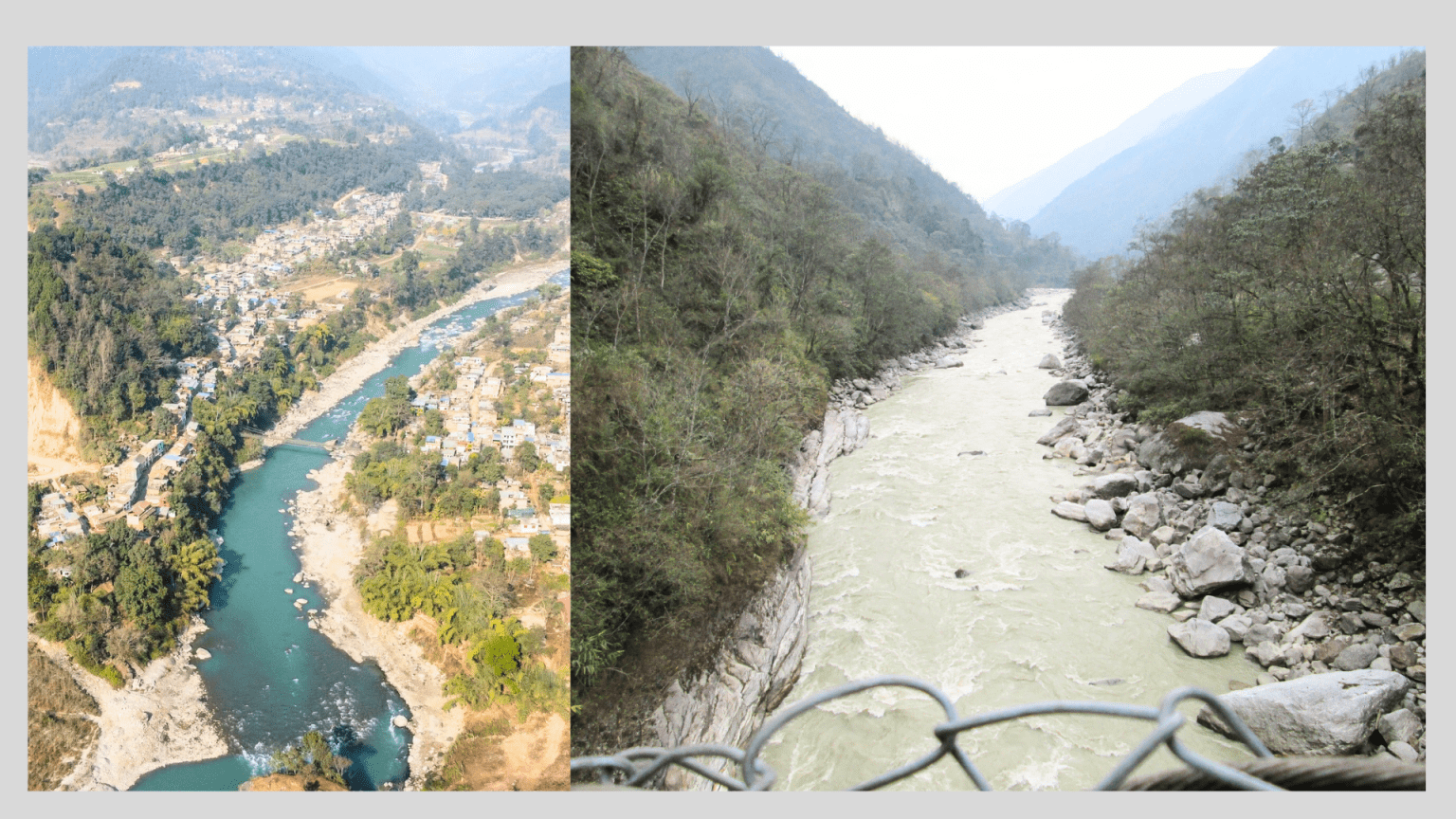

KATHMANDU : In terms of electricity production, the 1061 MW upper Arun identified in the Arun River is considered to be a very attractive semi-reservoir hydropower project. If the construction can be completed within the year 2030, it will be possible to build this project at an average cost of 200 million rupees. However, it is very difficult to manage the financial resources for the construction of such a large hydropower project. Nepal Electricity Authority through its subsidiary Upper Arun Hydro Electric Company Limited has advanced the construction process of this semi-reservoir project with 70 percent loan and 30 percent self share of the total cost. However, it is now very difficult to get loans and self capital investments from domestic and foreign banks and financial institutions for projects that require an investment of 2 trillion 14 billion rupees.

To complete the construction of this project, there is a need to mobilize an investment of 150 billion rupees through foreign and domestic loans. It seems that 64.46 billion rupees will have to be raised for self capital investment, which will be 30 percent of the total cost. In terms of Nepal’s investment potential, the cost required to build the Upper Arun Project is very large. This is the reason why we are struggling to raise the necessary investment for the construction of such a big project.

Recently, many hydropower projects that have been advanced through the subsidiary companies of the Electricity Authority have been extended and the costs are increasing, so will not the same type of problem arise in the future due to lack of funds in the Upper Arun project? The question also arises from time to time.

There is also concern about how to manage the additional investment when the construction period has been extended and the cost has increased after this project has gone into construction. If the cost increases during the construction of the project, what will happen to the loan repayment and the return of the project in order to raise more investment and increase foreign aid? There is another dilemma. However, under the leadership of Hydro Electricity Investment and Development Company (HIDCL), various banks and financial institutions of Nepal have committed to provide loans for the Upper Arun project.

An agreement has already been reached between HIDCL and banks and financial institutions regarding investment. According to the agreement, HIDCL and other banks and financial institutions have expressed their commitment to invest 53.44 billion rupees in Upper Arun. The Electricity Authority is also preparing to raise a foreign loan of 97.06 billion rupees from the World Bank. Executive Director of Electricity Authority Kulman Ghising says that the Upper Arun is a semi-reservoir hydroelectric project that is ready to go into construction.

“Upper Arun is almost as attractive as the reservoir project,” he says.”This project can give good production in dry season just like the reservoir projectHe says that the land acquisition has been completed to advance this project with some loan investment from the World Bank. According to him, the contractor for the construction of the access road for the project has been selected and mobilized. He also says that the loan investment agreement for Upper Arun will be signed within the current fiscal year.

The cabinet meeting held on Asoj 5, 2075 decided to build this project through Upper Arun Hydro Electric Company Limited, a subsidiary company under the Authority. Out of the 64.46 billion private capital investment of this project, there is a plan to manage the investment from the electricity authority, the general public and the people of the local project-affected areas. The authority will also own 41 percent shares in this project.

Arjun Kumar Gautam, the Chief Executive Officer of HIDCL, says that to raise investment for the construction of the semi-reservoir project, the traditional method of 70 percent loan and 30 percent self capital financing modality can be used. “Traditional financing modality can only be done in the construction of run-of-the-river and peaking projects,” he says. “This financing modality does not seem suitable for reservoir projects.” Chief Executive Officer Gautam claims that although there have been economic problems in Nepal recently, there will be no problem in investing loans in hydropower projects as banks and financial institutions have more than 55 billion worth of investable funds.

What is the financial performance of the hydroelectric projects currently in operation? How much return will investors get tomorrow? It is time to critically review the matter. He says, “Currently, most of the hydropower projects are not being completed within the specified time and cost, so there is a suspicion that the return will not be as expected.” He says that the people were assured that the return they would get when they invested yesterday, there is also a doubt/suspect that the return will not come in the same ratio.

Chief Executive Officer Gautam says that if the people are unable to protect the investments made in hydropower and give returns to the investors, large investments cannot be made in this sector.He says, “We have to seriously analyze the return of the hydroelectric project to the people and prepare an investment framework. If this is not done, people will hesitate to invest in the hydroelectric project in the future.” In the past, it was customary for the construction of large hydropower projects to be financed by foreign grants and subsidized loans or by the government. “In the coming days, there is no situation to manage the finances by taking foreign subsidies while constructing large-scale hydropower projects,”

He says, “Even if a project is to be constructed by taking a foreign loan, the same project should be able to pay back.” From now on, the government will not be able to bear the burden of the project and cannot. Chief Executive Officer Gautam says that the government should now adopt an innovative financing model rather than the traditional financing model in the construction of hydropower projects. People should not be allowed to invest in projects that are not financially suitable. There is always a risk of major accidents occurring in those projects. Nowadays, common people will invest without knowing or understanding. However, if we don’t get the reward, there will definitely be a serious problem,” he says.

Possible investment patterns

Chief executive officer Gautam says that the hybrid type of ‘blended financing’ (mixed investment) investment pattern should be adopted in the upcoming hydropower projects. There will also be blended financing. There will also be commercial loans. It is also suitable for self-financing and if the model of VGF is adopted, it is suitable for constructing the project,” he says.

The project can be made investable if the government provides the amount of the VGF grant. These types of models are only suitable for special projects. These models are not suitable for all types of projects. It seems that large hydropower projects would be suitable to be built in the ‘blended financing’ (mixed investment) model. In this model, when constructing a hydropower project, it is also possible to construct the project by mixing commercial loans and concessional loans. A hydropower project can also be constructed by mixing both subsidized loans and commercial loans from foreign donors.

Chief Executive Officer Gautam says that the Upper Arun Hydropower Project is going to be constructed in a blended financing model. We also take commercial loans for the construction of this project. There is also talk of construction by taking concessional loans. We hope to qualify for financing by mixing both,” he says.

Another model is to separate the dam and power plant of the reservoir hydroelectric project. Even if this model could be implemented practically, the project could be built. The government can make the necessary investment to build the dam of the reservoir project. By developing the dam as a multi-purpose project, income can be generated by promoting tourism. The power plant can be built and operated separately.

Separate companies such as HIDCL, NIFRA Bank and others have been set up to invest in infrastructure projects including hydropower. These companies can invest in the construction of large reservoirs and semi-reservoir hydropower projects in Nepal by raising cheap funds from domestic and foreign markets. They can also invest by converting the money in the market into cheap money. To make the Tamor project financially viable, companies and financial institutions like HIDCL can issue bonds specifically for the project. Banks and financial institutions buy the bonds after they are issued.That property will remain as an asset of banks and financial institutions. Banks and financial institutions will have to account for that capital in the form of Statutory Liquidity Ratio (SLR).

More than 8.5 billion investment is needed to build 9 projects in 12 years

The Electricity Authority has projected that 865 billion rupees will be required for the construction of 9 large hydropower projects in the next 12 years.

According to the corporate business plan of the Electricity Authority, it is projected that 865 billion rupees will be required for the construction of 9 hydropower projects in the period from 2023 to 2035.

It is estimated that an annual investment of 67 billion rupees will be required to advance projects including 140 MW Tanahun Reservoir, Tamakosi-5, Modikhola, 635 MW Dudhkoshi Reservoir, 1061 MW Upper Arun, Uttarganga, Chaitpur Seti, Rahughat, Trishuli-3 ‘B’ .

Ashish Garg, Vice President of Independent Power Producers Association, Nepal (IPAN), says that the task of managing financial resources to build hydropower projects in Nepal is very challenging.”In Nepal, there is a serious problem of lack of investable capital in hydropower,” he says, adding, “At present, the ability of banks to invest has also become very weak.” In the current situation, banks do not have enough capital.

Vice President Garg Nepal says that investments should be made in the construction of hydropower projects in the country by using various tools including Green Climate Fund/Green Bond. “As far as possible, Nepal should try to get concessional loans from international platforms,” he says. Since India is the main market for hydropower projects, there is a need to bring in investment from the government and private sector from India.’ Garg claims that since it will be easy to supply the electricity produced by Nepal to the Indian market, if there is strategic investment from India, both the investment and the market in the hydropower sector will be safe.

2,650 MW of installed capacity, more than half of which is in the private sector

According to the Electricity Authority, the country’s electricity capacity has reached 2,650 megawatts. The share of the private sector in this installed capacity is equal to 1511 megawatts. Even the projects completed by the private sector in average at a cost of around 180 million rupees per megawatt, more than 271 billion rupees have been invested in hydropower.

The connected capacity of power projects under the power authority is 661 megawatts and 478 megawatts is connected to the power transmission system from the completed hydroelectric power plant through the authority’s subsidiary company.

Investment of private sector in under construction is 500 billion

The private sector is still constructing 2,493 MW hydropower projects.

498 billion rupees have been invested even if the investment in private sector hydropower projects under construction is calculated at the rate of 200 million per megawatt. According to IPAN, 31.6 billion rupees have been spent so far at the rate of 20 million rupees per megawatt for hydropower projects with a capacity of 1,553 megawatts under Power Purchase Agreement (PPA). Still 11 thousand 716 MW hydropower projects are waiting for their turn to PPA.

For these projects, the private sector has already spent more than 15 million per megawatt. 175 billion rupees have been spent by the private sector for those projects.According to IPAN, 12,000 megawatt projects are in the process of getting study permits. 72 billion rupees have already been spent on projects that are in the process of obtaining study permits.

IPAN President Krishna Prasad Acharya claims that the private sector’s investment in hydropower will reach over 3 trillion within the next 10 to 15 years. He says that this amount of investment will reach the hydropower projects that have been built so far, are under construction and are going to be built.

Foreign Direct Investment in hydropower

Through the facilitation of the Board of Investment, direct foreign investment has entered into the 900 MW Arun 3rd hydropower project. Arun III project is being built at a fast pace with direct investment from Indian government company.So far, 61 percent of this project has been completed. SJVN Arun III Power Development Company is constructing this project with 70 percent loan and 30 percent self capital investments.

30 percent of the total investment is the promoter SJVN Arun III Power Development Company’s self capital, 60 percent is from 5 banks in India and the remaining 10 percent is loan investment from two banks in Nepal. Out of the fixed cost of Rs 11,000 crore for this project, SJVN, which is owned by the Government of India, has invested 30% of its own capital and 7 banks have invested 70%. Because of this, direct foreign investment in hydropower projects is increasing now.

86 percent of the total foreign investment in hydropower

According to the data of Nepal Rastra Bank, foreign direct investment in Nepal is around 19 billion. In the fiscal year 2078/79, foreign direct investment was 18 billion 560 million rupees.

In that fiscal year, 88.5 percent of the foreign investment was in the industrial sector. Similarly, 3.5 percent foreign investment came in the service sector and 7.9 percent in other sectors.

Out of the total foreign investment in the industrial sector in the last fiscal year, only 86.2 percent of the foreign direct investment was in hydropower projects. According to Rashtra Bank, 19.51 billion foreign direct investments were received in Nepal in the fiscal year 2077/78 and 19.47 billion foreign direct investments in the fiscal year 2076/77. Through the Board of Investment, the Indian company NHPC has received a survey permit to conduct a detailed study of the 750 MW West Seti Reservoir and the 450 MW Seti River-6 Hydropower Project.

NHPC is preparing to invest USD 1,320 million in West Seti hydropower project.

Similarly, the cost of 450 MW Seti River-6 is estimated at 800 million US dollars. Indian company Gandhi Malkiarjun Rao also in the 900 MW Upper Karnali Hydroelectric Project.

(GMR has already committed to invest approximately 1.6 trillion rupees. Due to the Supreme Court’s interim order last Kartik, the work on the Upper Karnali Hydroelectric Project could not proceed.

The need is high, the investment is low

By the year 2030, the government’s goal is to increase the power generation to 15,000 megawatts. Although the installed capacity has reached 2,650 MW, it is less than the government target. During this period, it seems that about 20 billion rupees more investment in hydropower will be required to complete the projects currently under construction and to complete the projects that are ready for construction. Similarly, the government has set a target of increasing the share of electricity produced from renewable energy sources to 50 percent. The government’s goal is to have 50 percent of public vehicles be electric vehicles and 60 percent of household kitchens with clean energy.

To achieve this goal, an annual investment of more than 600 billion rupees is required. However, at present, the government is allocating a budget equal to one billion rupees for hydropower. On the other hand, even in the banks that invest in hydroelectricity, the amount eligible for loan investment is only 300 billion rupees. Because of this, there is still a lack of investment to meet the ambitious goals of the government.